Investors bet billions on healthcare startups with paltry post records

According to an analysis of nearly 50 biomedical ‘unicorns’, venture capital-backed companies valued at over $ 1 billion, the post record of healthcare start-ups does not appear to matter to Investors.

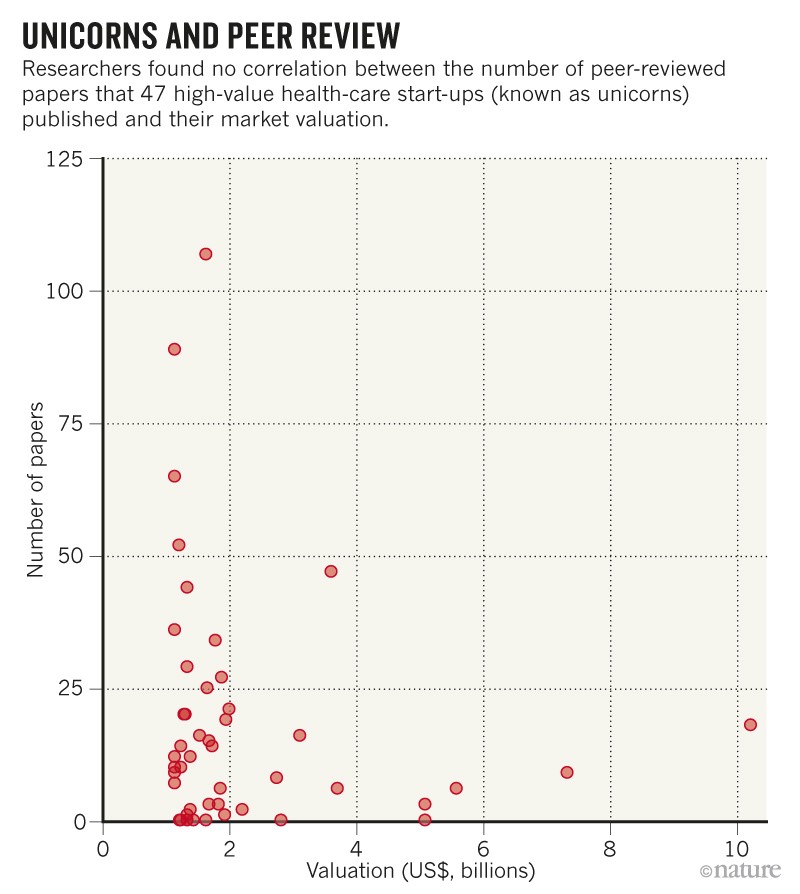

Analysis1, led by health policy researcher John Ioannidis at Stanford University in California, finds no correlation between a company’s market valuation and its publication record – defined as the number of peer-reviewed articles written directly by a company. This is a source of concern, say the authors.

Of the 47 unicorns analyzed, almost half had not published any highly cited article, defined as having at least 50 citations.

Eight companies had not produced any publications (see “Unicorns and peer review”). And half of the papers published on the work of the 47 companies were written by just 2 of them: personal genomics company 23andMe in Mountain View, Calif., And Adaptive Biotechnologies, headquartered in Seattle, Washington, which manufactures treatments for the immune system. system troubles.

“I didn’t expect we would find such a scarcity or dearth of publications,” says Ioana Cristea, psychologist at Babeş-Bolyai University in Cluj-Napoca, Romania, and co-author of the study.

The analysis focused on companies around the world that are developing biomedical products ranging from RNA treatments to prosthetic knees.

Editing is chargeable

The findings mean that investors and the public could base their expectations of a company’s products on evidence that is less closely scrutinized – such as information in patents, press releases, and self-published reports – than those provided by the peer-reviewed literature, suggests the analysis.

“Health products that are not peer reviewed but rather based on the sole generation of internal data can be problematic and unreliable,” the authors conclude.

The authors suggest that the effort put into publishing can pay off in the long run. Ultimately, a lack of evidence can mean that health products fail to gain approval from regulatory bodies such as the United States Food and Drug Administration; lead to lawsuits for defective products; and even cause damage. The analysis gives several examples of such results for companies that did not publish many peer-reviewed articles.

Cristea recognizes that the peer review process is not perfect. “Peer review misses a lot and has a lot of problems and failures,” she says. “But also the alternative of nothing is, I think, even more problematic.”

Rather, potential investors might look at the evidence presented in a company’s patents, but patents don’t always reveal flaws in a company’s data. “If you see a company that hasn’t really published anything to back up their claims, that might be a signal to take heed,” Cristea says.